A graphic in a March 24 Boston Globe article about property taxes reveals that Lincoln has the third-highest average property tax bill in Massachusetts. The only municipalities with higher average bills (for cities and towns where data was available) were Weston and Sherborn. The top 10 were as follows:

| Weston | $18,059 |

| Sherborn | $14,720 |

| Lincoln | $14,367 |

| Dover | $13,715 |

| Wellesley | $13,326 |

| Carlisle | $13,127 |

| Concord | $12,890 |

| Lexington | $12,191 |

| Wayland | $12,049 |

| Sudbury | $11,598 |

| Cohasset | $11,114 |

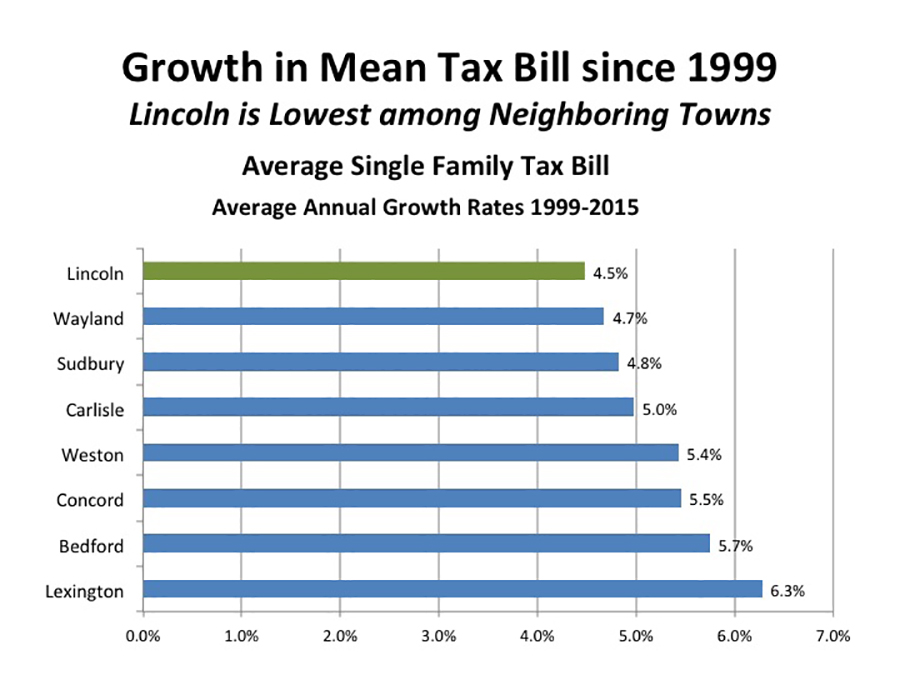

On the other hand, the pace at which Lincoln’s tax bills have been increasing since 1999 is the lowest among eight area towns, according to data presented by the Finance Commission at Town Meeting last month. Lincoln’s average bill has gone up by 4.5 percent during that time, while Lexington’s has gone up the fastest at 6.3 percent:

Growth in average property tax bills in Lincoln compared to other area towns since 1999 (click to enlarge).

Taxes in fiscal 2016

In fiscal 2016, Lincoln’s average tax bill is expected to rise by 3.9 percent (it won’t become official until the town sets the tax rate in July). Most of that increase is due to the appropriations at Town Meeting of $750,000 for a school project feasibility study and $75,000 for a school campus master plan. Without those two items, the average tax bill would have gone up by only 0.8 percent.

Since 2011, the average Lincoln tax bill has risen by an average of 4.26 percent:

| Fiscal year | 2011 | 2012 | 2013 | 2014 | 2015 | Total 2011-2015 |

| Change in average tax bill in Lincoln |

6.08% | 7.48% | -0.51% | 3.68% | 4.54% | 4.26% |

| Change in average home value in Lincoln |

-1.64% | -3.47% | -3.32% | 2.45% | 6.75% | 0.16% |